Zomato vs Swiggy: The battle of India’s food delivery titans - who offers better employee health benefits?

Food delivery in India has become synonymous with two names: Zomato and Swiggy. These giants are in a fierce tug-of-war for market dominance. Zomato has now maintained a sizeable lead over Swiggy in terms of execution but let's find out which of these food delivery behemoths is winning the battle for employee well-being!

If you want us to analyse the health insurance benefits offered by your company, please fill this form.

Whether you're currently employed at Zomato/ Swiggy or are considering an offer, this blog provides a detailed analysis of health insurance benefits offered by the food delivery giants.

It's essential to dissect your health insurance benefits to ensure you are adequately covered as your well-being and financial security depend on it.

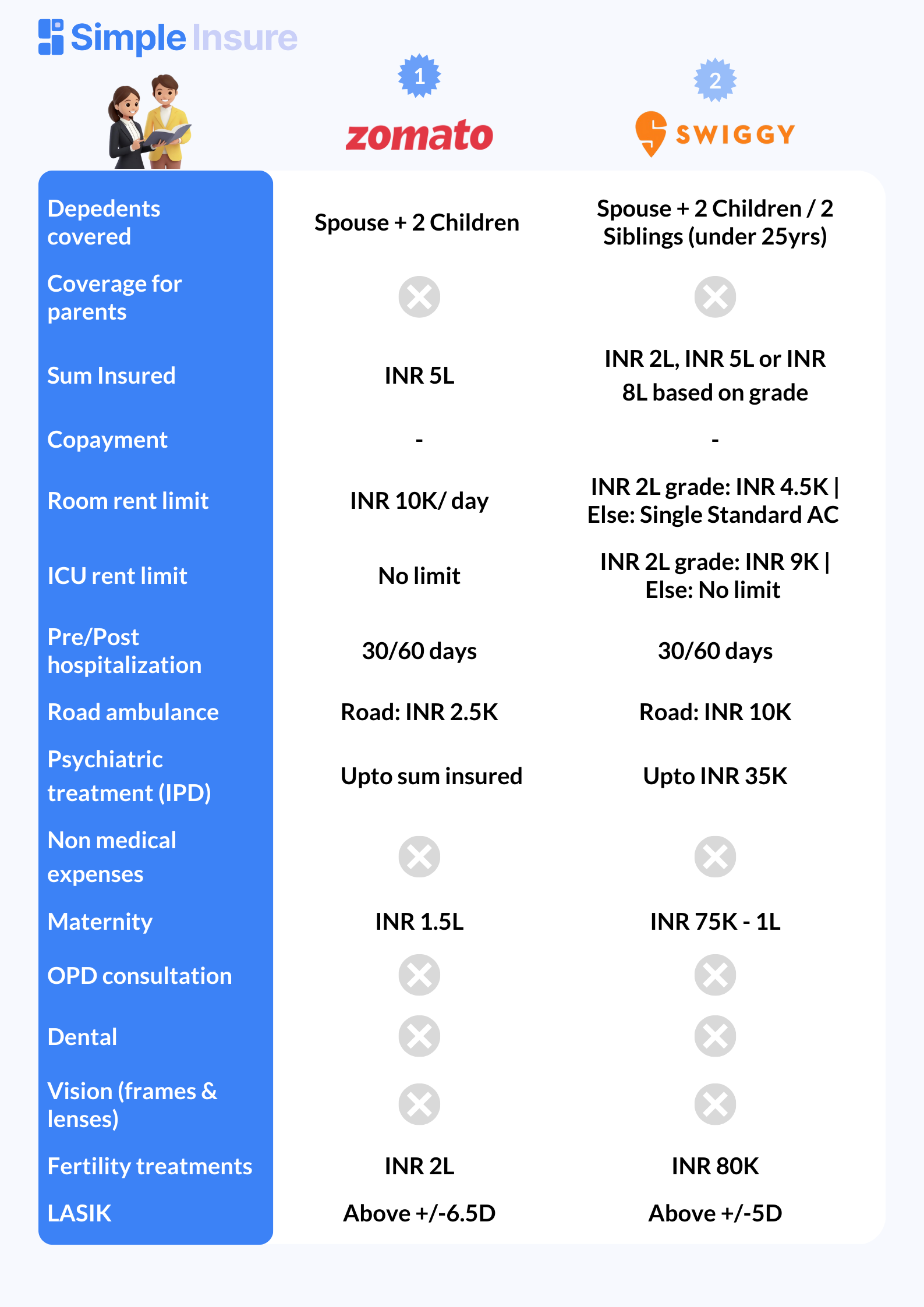

Summarising the benefits: Zomato and Swiggy

Below is the detailed break down of the key elements:

- Members covered: In addition to the employees, corporate health insurance might provide coverage for spouse, children and parents or parents-in-law.

- Zomato: Provides coverage for employee, spouse and 2 children up to the sum insured amount

- Swiggy: The policy covers employee, spouse, children (up to 2 children)/2 siblings (under 25 yrs of age), up to the sum insured

- Sum insured: Sum insured is the maximum limit up to which the health insurance company pays for medical expenses. The minimum recommended coverage in a metro city is typically around INR 10L.

- Zomato: A family floater sum insured of INR 5L

- Swiggy: A family floater sum insured of INR 2L, INR 5L and INR 8L based on the grade of the employee

- Base coverage benefits: Corporate plans usually come with sub-limits on core benefits, let's examine the coverage on key parameters of inpatient hospitalisation offered by Zomato and Swiggy:

| Features | Description | Zomato | Swiggy |

|---|---|---|---|

| Copayment | % of addmissable claim that you need to pay |

No copayment | No copayment |

| Pre & post hospitalisation |

Expenses incurred before and after hospitalisation are covered |

Pre-hospitalization: 30 days Post-hospitalization: 60 days |

Pre-hospitalization: 30 days Post-hospitalization: 60 days |

| Room rent limit |

Highest category room or rent a person can avail |

INR 10K/ day | INR 2L grade: INR 4.5K/ day Others: Single standard AC room |

| ICU rent limit | Highest ICU category or rent a person can avail |

No limit | INR 2L grade: INR 9K/ day Others: No limit |

| Day care treatments |

Treatments that don't require 24hr hospitalization |

Covered | Covered |

| Modern treatments |

Treatments that use ultra advanced technologies |

Covered with sub-limits (50% copay) |

Covered with sub-limits (50% copay) |

| Mental health (IPD) |

Treatments for psychiatric, psychological disorders |

Covered upto sum insured | Covered up to INR 35K |

| Waiting period |

Time frame after which the benefits are covered |

No waiting period | No waiting period |

| Ambulance charges |

Coverage for ambulance expenses in case of emergency |

Road ambulance upto INR 2.5K |

Road ambulance upto INR 10K |

| Non medical expenses |

Expenses not directly related to medical treatment |

Not covered | Not covered |

- Additional benefits: Let's take a look at what supplementary benefits Zomato and Swiggy offer to their employees:

| Benefits | Zomato | Swiggy |

|---|---|---|

| Maternity benefits |

Limit of INR 1.5L Pre & post natal care upto INR 10K |

Limit of INR 75K - 1L Pre & post natal care upto INR 5K |

| OPD | Not covered |

Not covered |

| Dental | Not covered | Not covered |

| Vision | Not covered | Not covered |

| Infertility treatments |

Covered upto INR 2L | Covered upto INR 80K |

| Lasik | Covered if the correction index is above +/-6.5D |

Covered if the correction index is above +/-5D |

| Egg freezing | Egg freezing is covered up to INR 75K per case |

Not covered |

While these firm provide you health insurance cover, it's crucial to remember that corporate health cover is not a comprehensive solution and you should supplement it with a personal health insurance plan.

Simple Insure AI can help you find the right plan that complements your corporate coverage and help you evaluate the voluntary benefits and whether you should opt for them.

Use the links below to learn more about your corporate cover and find the best personal health insurance plans for your family:

Zomato: Click here

Swiggy: Click here

For any queries reach out to us at founder@simpleinsure.ai