HUL, ITC and P&G: A deep dive into health insurance benefits at FMCG giants

With a massive workforce of ~50K, ITC is one of the largest employers in India’s FMCG sector. But how do their health care benefits stack up against those of HUL and P&G?

Whether you’re currently employed at HUL, ITC or P&G, or considering an offer from one of these industry giants, this blog offers a thorough analysis of the health insurance benefits they provide.

It's essential to understand and make the most of your health coverage to ensure you're fully protected and not missing out on potential financial benefits.

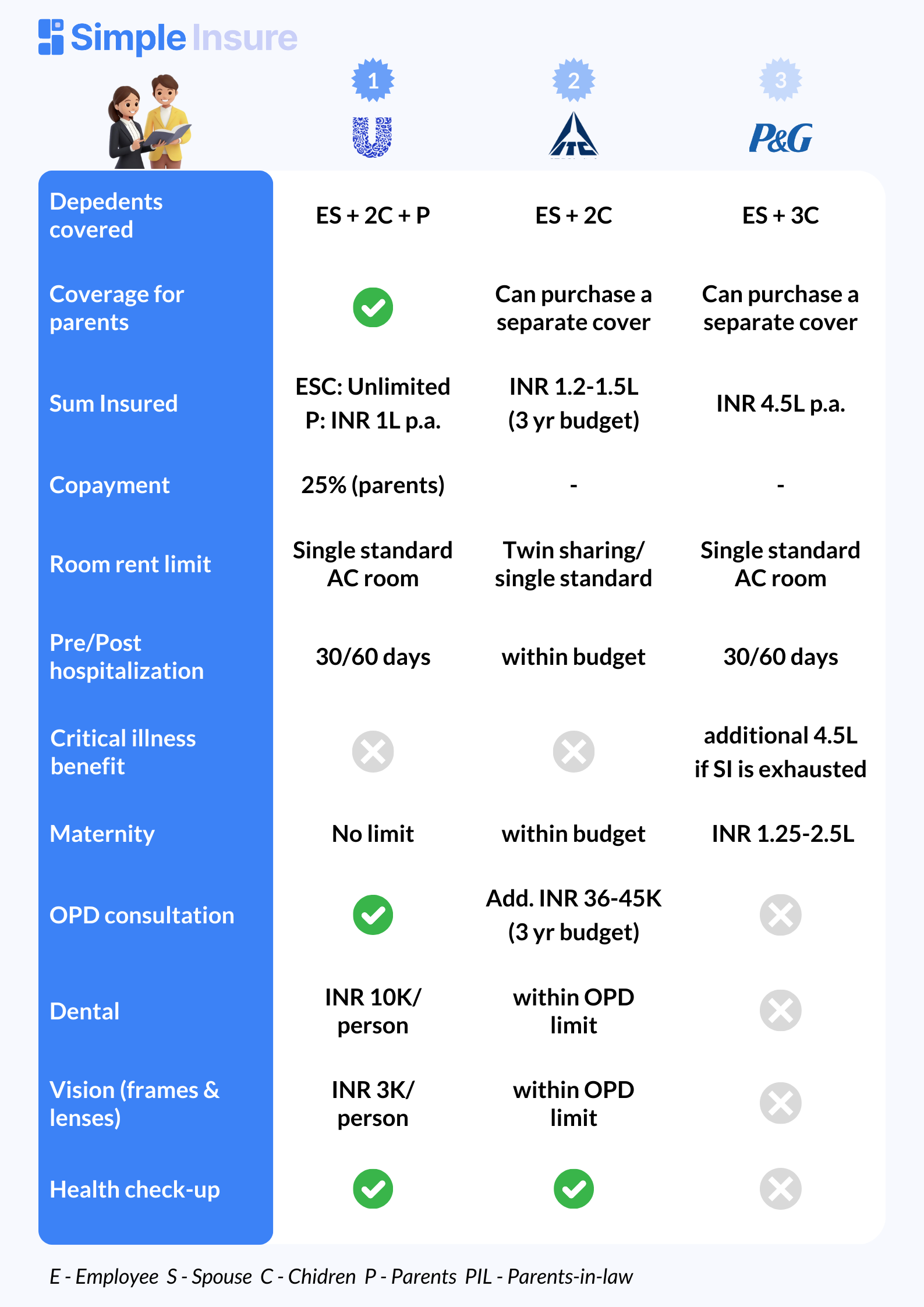

Summarising the benefits: HUL, ITC and P&G

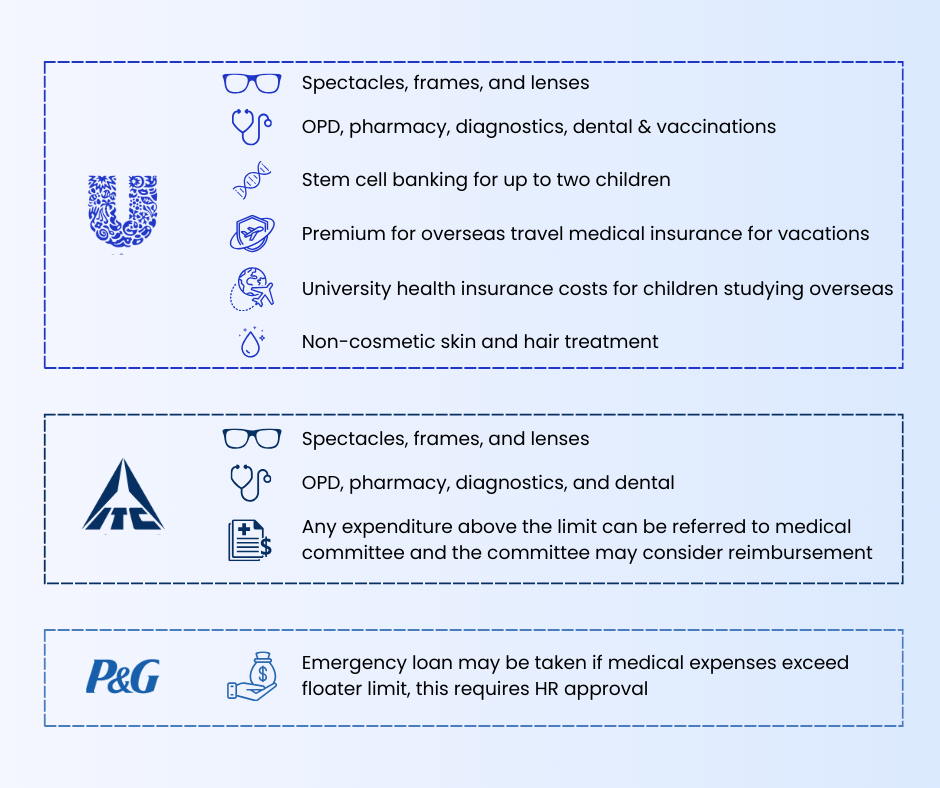

Did you know that your health insurance covers expenses like spectacles, lenses, dental treatment, and more? Don’t miss out on these valuable benefits included in your corporate plan!

Here's a detailed breakdown of the corporate health insurance policies offered by HUL, ITC, and P&G:

- Members covered: In addition to covering employees, corporate health insurance may also provide coverage for the employee's spouse, children, and parents or parents-in-law.

- HUL: Provides coverage for employee, spouse, two children (upto age of 25 years) and parents. Parents in law are not covered.

- ITC: Provides cover for employee, spouse and two dependent children up to the age of 24 years.

- P&G: Policy covers employee, spouse & three dependent children (up to the age of 25 years, provided they are not employed or married)

- Sum insured: Sum insured is the maximum limit up to which the health insurance company pays for medical expenses. The minimum recommended coverage in a metro city is typically around INR 10L.

- HUL: Unlimited cover for employee, spouse and children. A maximum limit of INR 1L per annum per parent enrolled in the policy.

- ITC: 3-year medical budget of INR 1.2-1.5L for hospitalisation and INR 36-45K for domiciliary/ OPD treatment based on the employee grade.

- P&G: A family floater sum insured of INR 4.5L per annum.

- Base coverage benefits: The table below compares the base coverage benefits across these three companies on key parameters such as copayment, pre & post-hospitalisation, and room rent limits:

| Features | Description | HUL | ITC | P&G |

|---|---|---|---|---|

| Copayment | % of addmissable claim that you need to pay |

25% on parental claims | No copayment | No copayment |

| Pre & post hospitalisation |

Expenses incurred before and after hospitalisation are covered |

Pre-hospitalization: 30 days Post-hospitalization: 60 days |

Within the overall medical budget |

Pre-hospitalization: 30 days Post-hospitalization: 60 days |

| Room rent limit |

Highest category room or rent a person can avail |

Single standard AC room | Twin sharing/ Single standard | Single standard AC room |

| Day care treatments |

Treatments that don't require 24hr hospitalization |

Covered | Covered | Covered |

| Waiting period |

Time frame after which the benefits are covered |

No waiting period | No waiting period | No waiting period |

| Critical illness | Additional cover on diagnosis of critical illness |

No | No | INR 4.5L additional if base sum insured get exhausted |

- Additional benefits: Let's explore the additional health and wellness benefits provided by these FMCG giants:

| Benefits | HUL | ITC | P&G |

|---|---|---|---|

| Maternity benefits |

No limit | within the overall medical budget |

Limit of INR 2.5L in metro; 1.25L in non-metro within the overall SI |

| OPD consultation & pharmacy |

Covered; medicines cost not covered for parents |

Additional INR INR 36K - INR 45K budget for a 3 year period |

OPD is not covered under this policy |

| Diagnostics | Covered | within the OPD budget | OPD is not covered under this policy |

| Dental | Covered (except for parents) upto INR 10K per person |

within the OPD budget | OPD is not covered under this policy |

| Vision (Frames & lenses) |

Covered (except for parents) upto INR 3K per person |

within the OPD budget | OPD is not covered under this policy |

| Health check-up |

Once in 2-3 years based on age of the employee |

Once in 2-5 years based on age of employee |

OPD is not covered under this policy |

| Other benefits |

Stem cell banking, travel insurance cost for leisure trip, university health insurance cost for children studying overseas |

Emergency loan can be taken if medical expenses exceed floater limit |

Any expenditure above the limit can be referred to medical committee and the committee may consider reimbursement |

While these firm provide you health insurance cover, it's crucial to remember that corporate health cover is not a comprehensive solution and you should supplement it with a personal health insurance plan.

Simple Insure AI can help you find the right plan that complements your corporate coverage and help you evaluate the voluntary benefits and whether you should opt for them.

Use the links below to learn more about your corporate cover and find the best personal health insurance plans for your family:

HUL: https://wa.me/message/KP7RZWUWJ56OI1

ITC: https://wa.me/message/MQQQ3MT6QHUXD1

P&G: https://wa.me/message/B2KTCHIQCIJWG1

For any queries reach out to us at founder@simpleinsure.ai