Flipkart, Amazon and Meesho: A deep dive into health benefits at India's top e-commerce firms

Who is winning the e-commerce race among Flipkart, Amazon, and Meesho in India? While there's plenty of coverage on that front, it's not just about market share - it's also about attracting and retaining top talent. And one crucial factor in that equation is employee health benefits.

If you want us to analyse the health insurance benefits offered by your company, please fill this form.

All three firms are renowned for delivering excellent customer service, but let's find out which of these e-commerce behemoths is truly winning the battle for employee well-being!

It's essential to dissect your health insurance benefits to ensure you are adequately covered as your well-being and financial security depend on it.

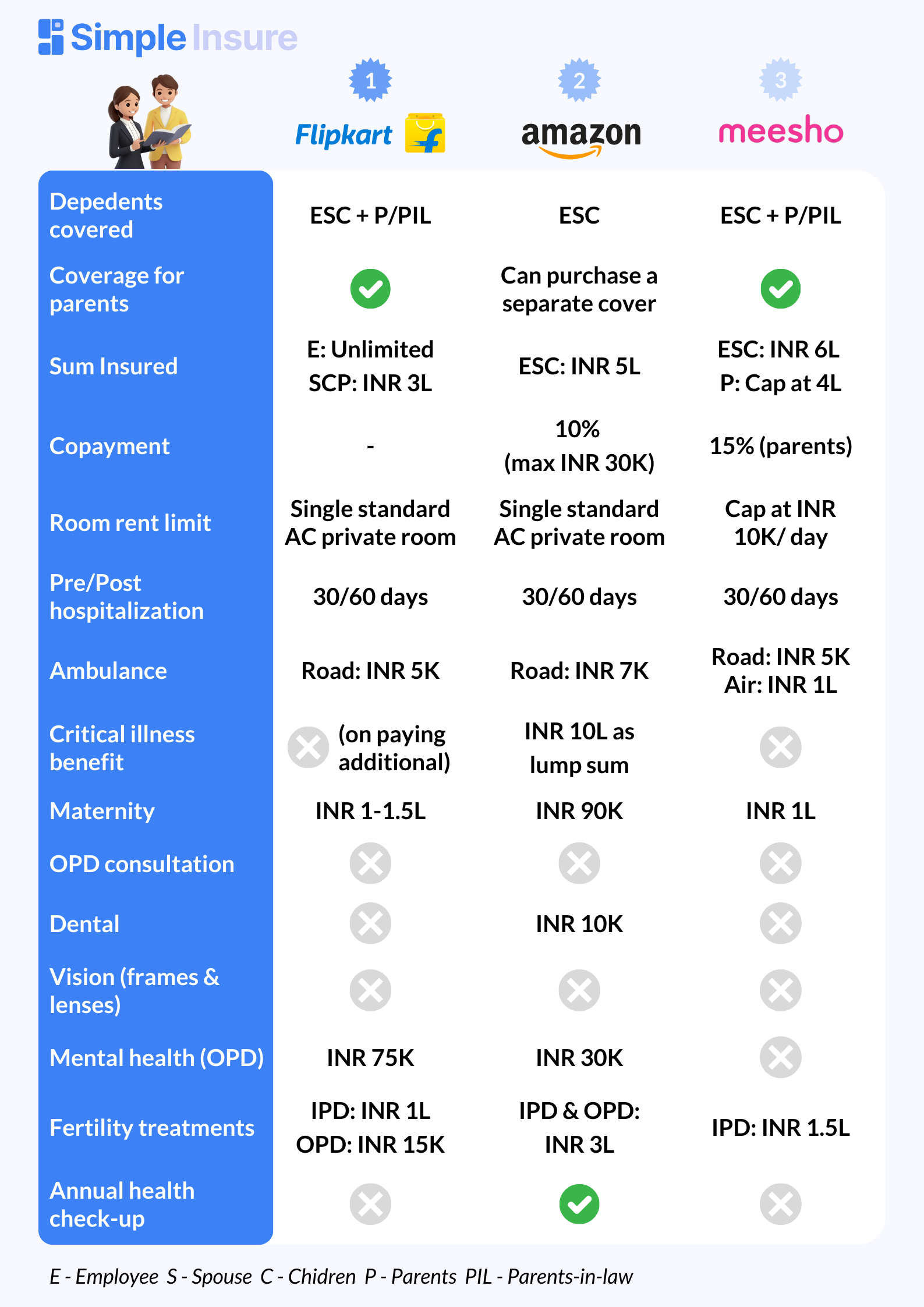

Summarising the benefits: Flipkart, Amazon and Meesho

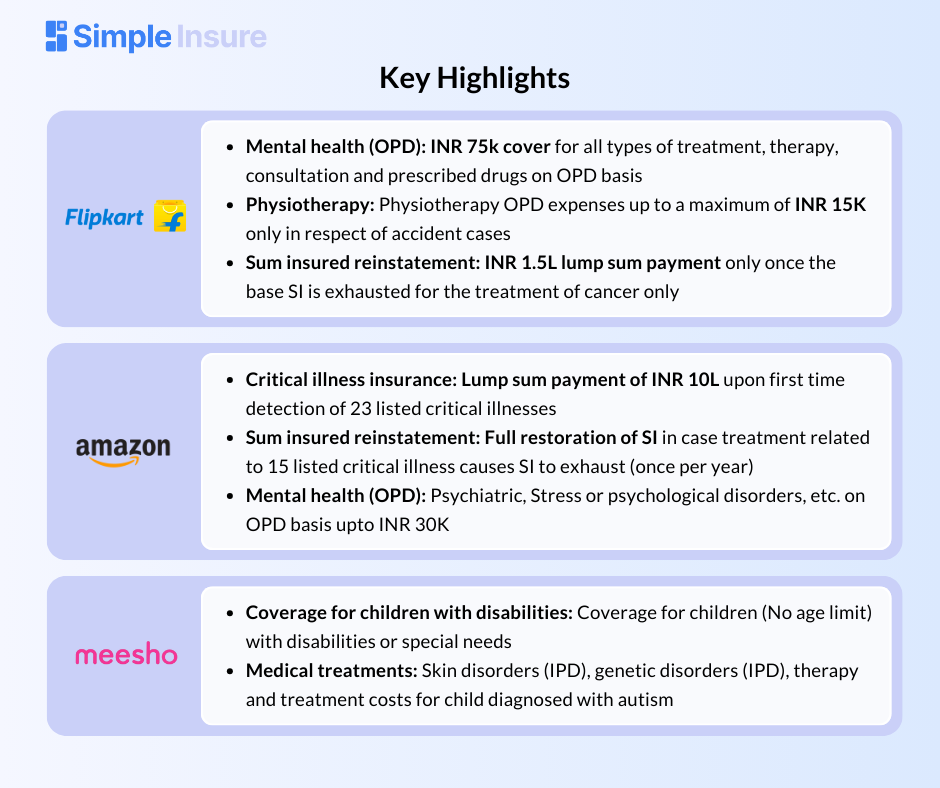

Key highlights in the policies:

Below is the detailed break down of the key elements:

- Members covered: In addition to the employees, corporate health insurance might provide coverage for spouse, children and parents or parents-in-law.

- Flipkart: The default option covers spouse, children and parents. Employees can choose from various family structures (C only, SC, ZP, P, SP/PIL, SCP/PIL) based on flex points or by paying an additional premium.

- Amazon: Provides default coverage for employees, spouse and children. Employees can change the family composition from ESC to E only / ES / EC and generate flex points. With flex points and salary deduction, employees can pay for voluntary plans or higher SI. Employees can purchase voluntary parental plan to cover their parents.

- Meesho: Offers coverage for employees, spouses, children, and parents.

E - Employee, S – Spouse, C – Child, Z – Siblings, P – Parents and PIL-Parents-in-law

- Sum insured: Sum insured is the maximum limit up to which the health insurance company pays for medical expenses.

- Flipkart: Offers unlimited cover for employees and the default option for dependents is SCP for INR 3L. Employees can opt for cover from INR 3L - 6OL through flex points or salary deduction.

- Amazon: A family floater sum insured of INR 5L for ESC. Employees can opt for higher cover INR 5L - 2OL. The cost for opting higher sum insured will be deducted from payroll and my flex points.

- Meesho: Offers a family floater sum insured of INR 6L for ESC+P/PIL with a cap of INR 4L for parents.

- Base coverage benefits: Let's examine how these firms compare on key parameters of inpatient hospitalisation:

| Features | Description | Flipkart | Amazon | Meesho |

|---|---|---|---|---|

| Copayment | % of addmissable claim that you need to pay |

No copayment | 10% co-pay subject to max. of INR 30K |

15% co-pay applicable on all parental claims |

| Pre & post hospitalisation |

Expenses incurred before and after hospitalisation are covered |

Pre-hospitalization: 30 days Post-hospitalization: 60 days |

Pre-hospitalization: 30 days Post-hospitalization: 60 days |

Pre-hospitalization: 30 days Post-hospitalization: 60 days |

| Room rent limit |

Highest category room or rent a person can avail |

Single standard AC private room |

Single standard AC private room |

Room rent capped at INR 10K per day |

| Day care treatments |

Treatments that don't require 24hr hospitalization |

Covered | Covered | Covered |

| Modern treatments |

Treatments that use ultra advanced technologies |

Covered with sub-limits | Covered with sub-limits | Covered with sub-limits |

| Mental health (IPD) |

Treatments for psychiatric, psychological disorders |

Coverage of up to INR 300k | Covered up to sum insured | Covered up to 10% of base sum insured |

| Critical illness (CI) rider |

Lump sum payment on diagnosis of critical illness |

On additional pay (INR 5-20L on diagnosis of 18 listed CI) |

INR 10L lump sum payment on diagnosis of 23 listed CI |

Not covered |

| Waiting period |

Time frame after which the benefits are covered |

No waiting period | No waiting period | No waiting period |

| Ambulance charges |

Coverage for ambulance expenses in case of emergency |

Road ambulance upto INR 5K |

Road ambulance upto INR 7K |

Road ambulance upto INR 5K, air upto INR 1L |

| Genetic disorders |

Diseases are caused by mutations that are inherited from the parents |

Covered | Covered | Covered (upto 25% of sum insured) |

- Additional benefits: Corporate health cover also offer supplementary benefits like maternity, OPD, vision, dental, etc., for the overall well-being of employees. Let's take a look at what they offer:

| Benefits | Flipkart | Amazon | Meesho |

|---|---|---|---|

| Maternity benefits |

Limit of INR 1.5L Pre & post natal covered within maternity limit |

Limit of INR 90K Pre & post natal care upto INR 10K |

Limit of INR 1L Pre & post natal cover up to INR 5K |

| OPD consultation | Not covered (OPD plan can be bought with Flex points or through salary deduction) |

Not covered (Covered on paying additional premium) |

Not covered |

| Diagnostics | Not covered (covered with the OPD plan) |

Major diagnostics (from specified list) upto INR 5K |

Not covered |

| Vaccinations | Not covered (covered with the OPD plan) |

Covered (upto INR 1.4K) | Not covered |

| Dental | Not covered (covered with the OPD plan) |

Covered (upto INR 10K) | Not covered |

| Vision | Not covered (covered with the OPD plan) |

Not covered (Covered in the higher variant of the OPD plan) |

Not covered |

| Mental health (OPD) |

Covered upto INR 75K | Covered upto INR 30K per member |

Not covered |

| Annual health check-up |

Not covered (covered with the OPD plan) |

Covered (INR 2K) | Not covered |

| Infertility treatments |

Covered upto INR 1L | Covered upto INR 3L | Covered upto INR 1.5L |

| Other wellness benefits |

Plans (e.g, chronic, women, elder care) offered through a wellness provider on a paid basis |

Well-being tracker enabled by HealthifyMe; Online diet and nutrition counselling by Healthi |

Amazon employees can opt for higher OPD coverage from INR 10K - 30K by paying an additional premium. Similarly, Flipkart employees can choose to buy an OPD plan of INR 10K - 25K with their flex points or through salary deduction.

While these firm offer decent health insurance cover, it's crucial to remember that corporate health cover is not a comprehensive solution and you should supplement it with a personal health insurance plan.

Simple Insure AI can help you find the right plan that complements your corporate coverage and help you evaluate the voluntary benefits and whether you should opt for them.

Use the links below to learn more about your corporate cover and find the best personal health insurance plans for your family:

Flipkart: Click here

Amazon: Click here

Meesho: Click here

For any queries reach out to us at founder@simpleinsure.ai